Multiple Locations in Major Metro Market, Profitable and Growing

PROJECT STAR TREK: The company is a family-owned heavy-duty parts and service business with nearly 60 years in operation. It has multiple Western U.S. locations serving customers through counter sales, parts delivery, service and remanufacturing capabilities for heavy duty vehicles.

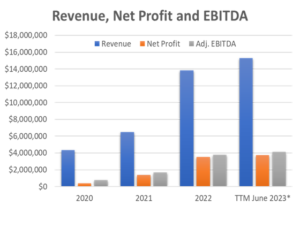

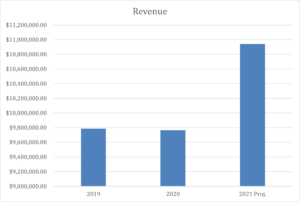

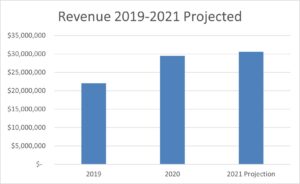

The company has unique under vehicle service capabilities and equipment,, as well being an authorized service center for leading OEMs. Parts distribution includes the top premium brands for heavy-duty and commercial vehicles. The company has experienced steady growth over several years with FY2023 revenue over $16.5M and over $1.1M adjusted EBITDA.

Customers include all types of commercial and heavy-duty vehicles for fleets, owner/operators and numerous municipalities including transit buses, school districts and first responder vehicles.

Company Details:

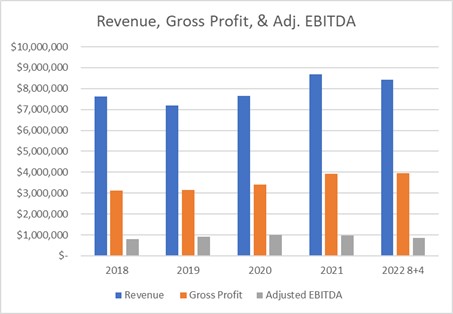

- 53% gross margin, service

- 41% gross margin, parts

- Strategic, major market locations

- Member of national buying group

- Extensive premium parts line card

- Certified service center for 2 OEMs

- Unique alignment and a/c service capabilities

- Remanufacturing center for critical components

- Succession plan in place

- Customer and employee values driven culture

For more information, return the NDA found here or contact:

Tom Marx

415-601-1787

TMarx@HartMarxAdvisors.com

Chris Bovis

785-764-6248

CBovis@HartMarxAdvisors.com