Long-Term Trends for the Light-Duty Automotive Aftermarket

The automotive aftermarket has a 50-year trend of growth and resiliency. Americans still utilize the automobile as the gateway to countless activities from the base necessities to luxuries like travel. The aftermarket broadly offers consumers greater choice and value in maintaining their vehicles, attributes that perform well in good and challenged economic conditions.

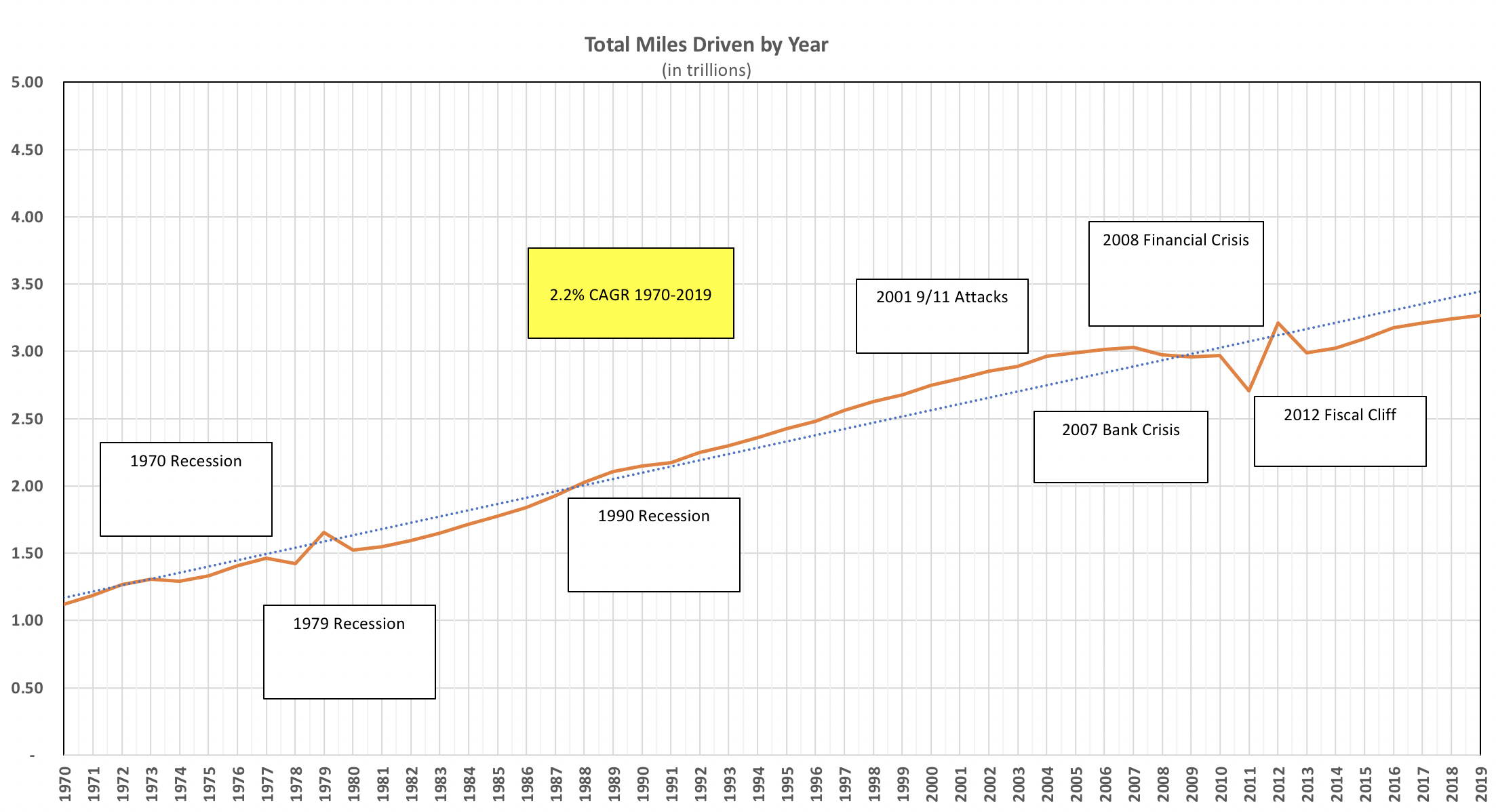

Parts and services sales rely on a couple of critical factors. Miles driven is the best predictor of parts replacement and service. Additionally, vehicle age is also an important driver as older vehicles result in more parts and service sales.

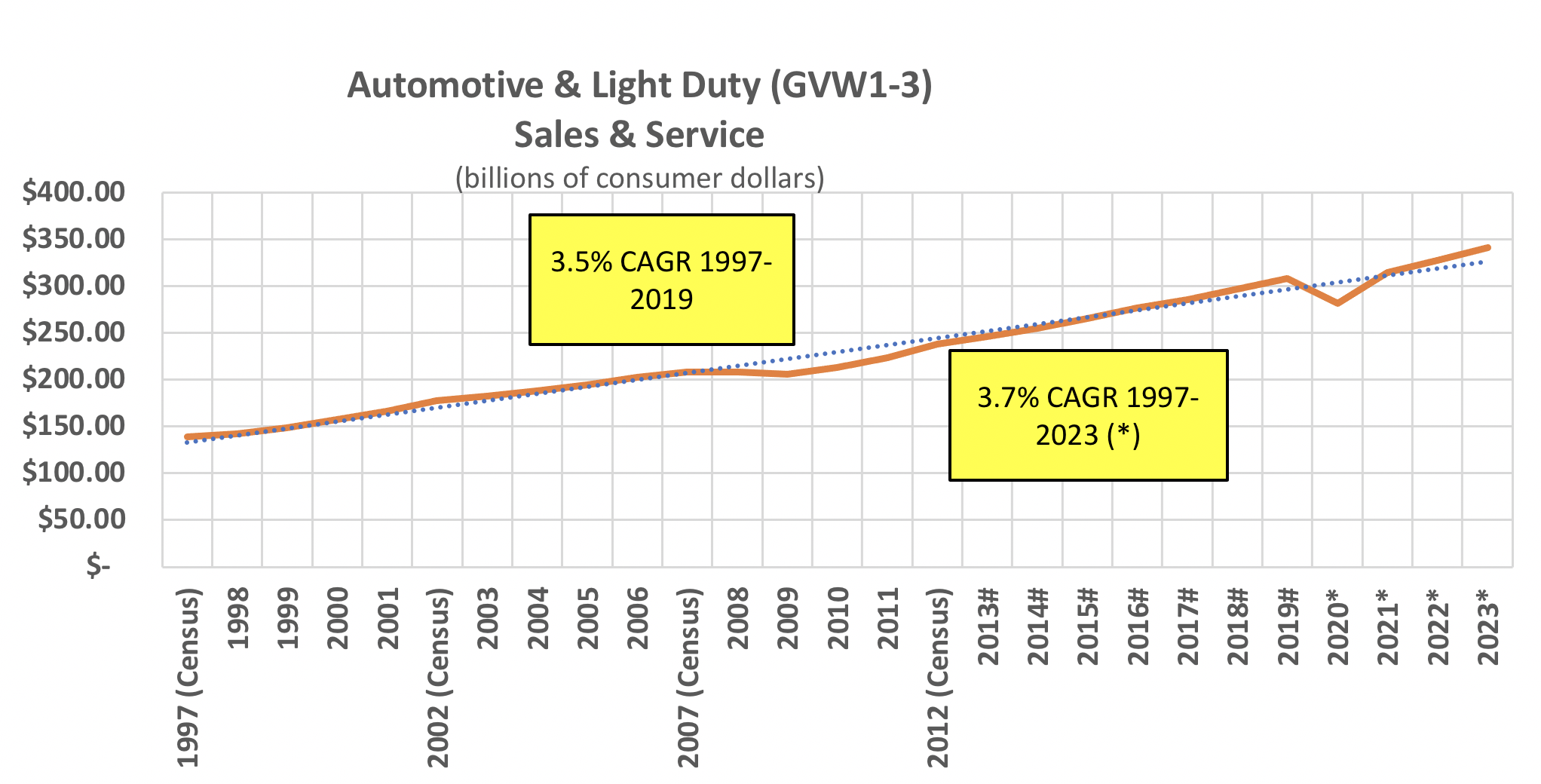

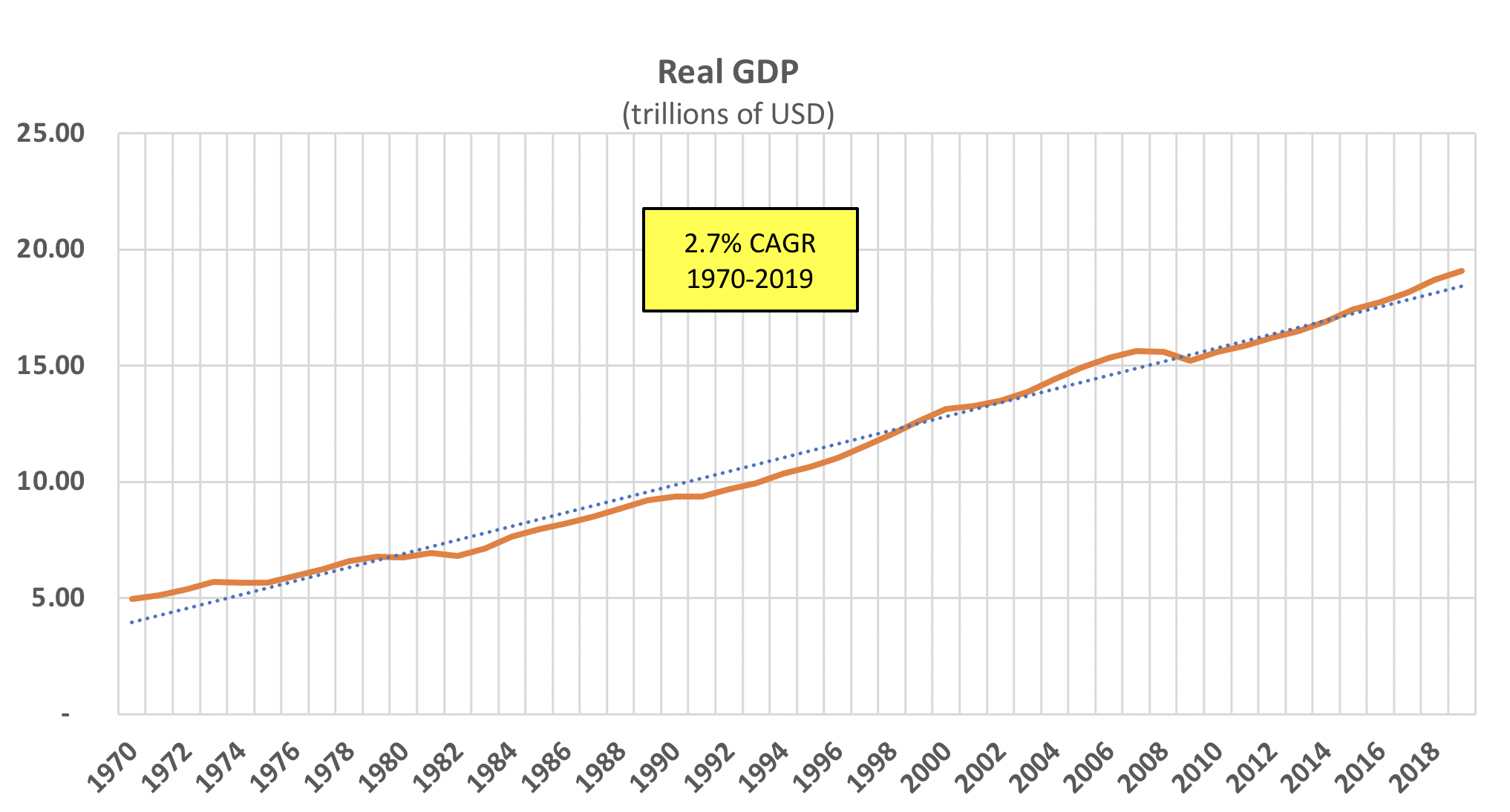

The long-term trend for the primary measurement of our economy…Gross Domestic Product (GPD)…has shown a steady growth for almost 50 years. The light duty automotive aftermarket is a very stable market with long-term positive trends similar to the GDP. Charts 2 and 3 below along with the supporting sets of data show these trends…even thru recessions and other major impacts to our economy.

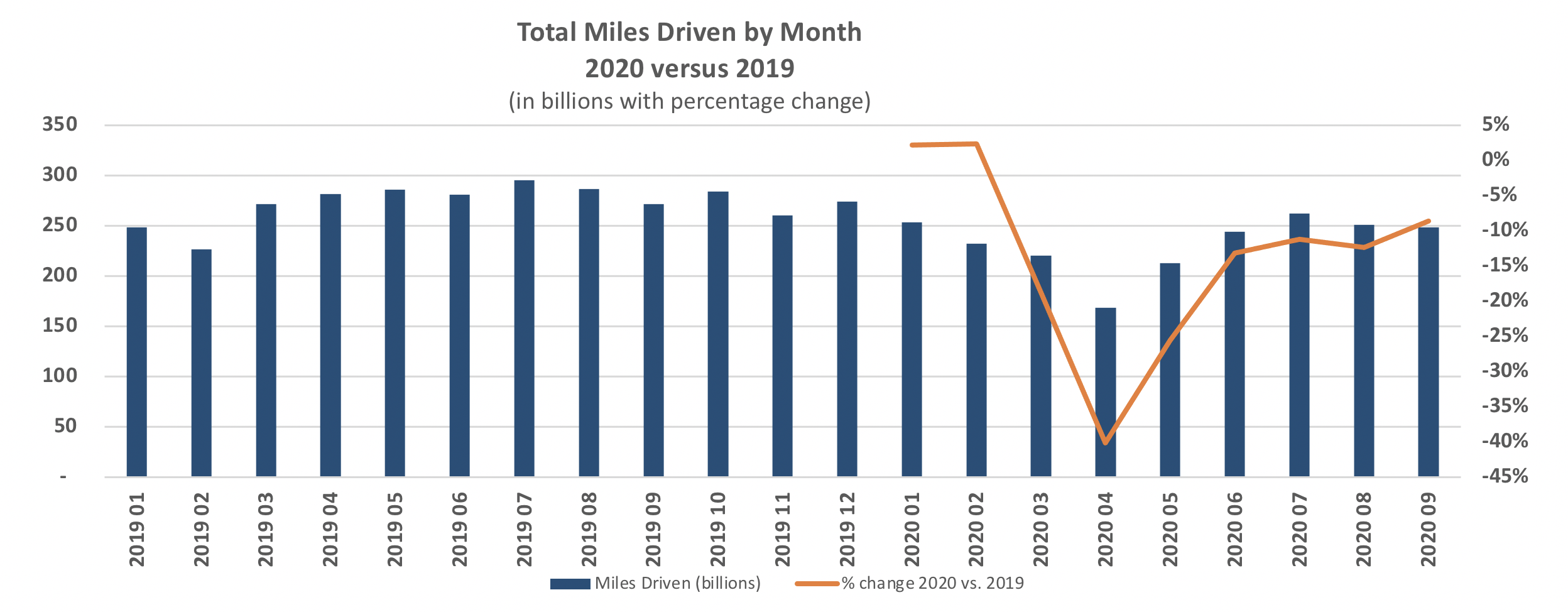

The Covid-19 impact in 2020 is following a similar pattern of dip and recovery to previous recessions (see chart 1). Miles driven in January and February 2020 were each over 2% higher than in 2019. The impact of Covid-19 began in March. By April vehicle miles were 40% lower than in 2019. After April vehicle miles increased significantly and by September were only down 8.6% as compared to 2019.

Driving to and from work represents 30% of light vehicle miles driven. While the long-term viability of working from home for select occupations remains unknown, the short-term impact is largely offset by the automobile being viewed as safer than air or other public transportation. Other top automobile uses include other work-related travel, visiting friends and relatives and driving to school, daycare and church. (1)(2) As people have begun to resume their normal activities miles driven has increased and is projected to continue to increase in the future. (3)

In addition to the positive miles driven trend there are other consistent and positive trends for the light vehicle aftermarket:

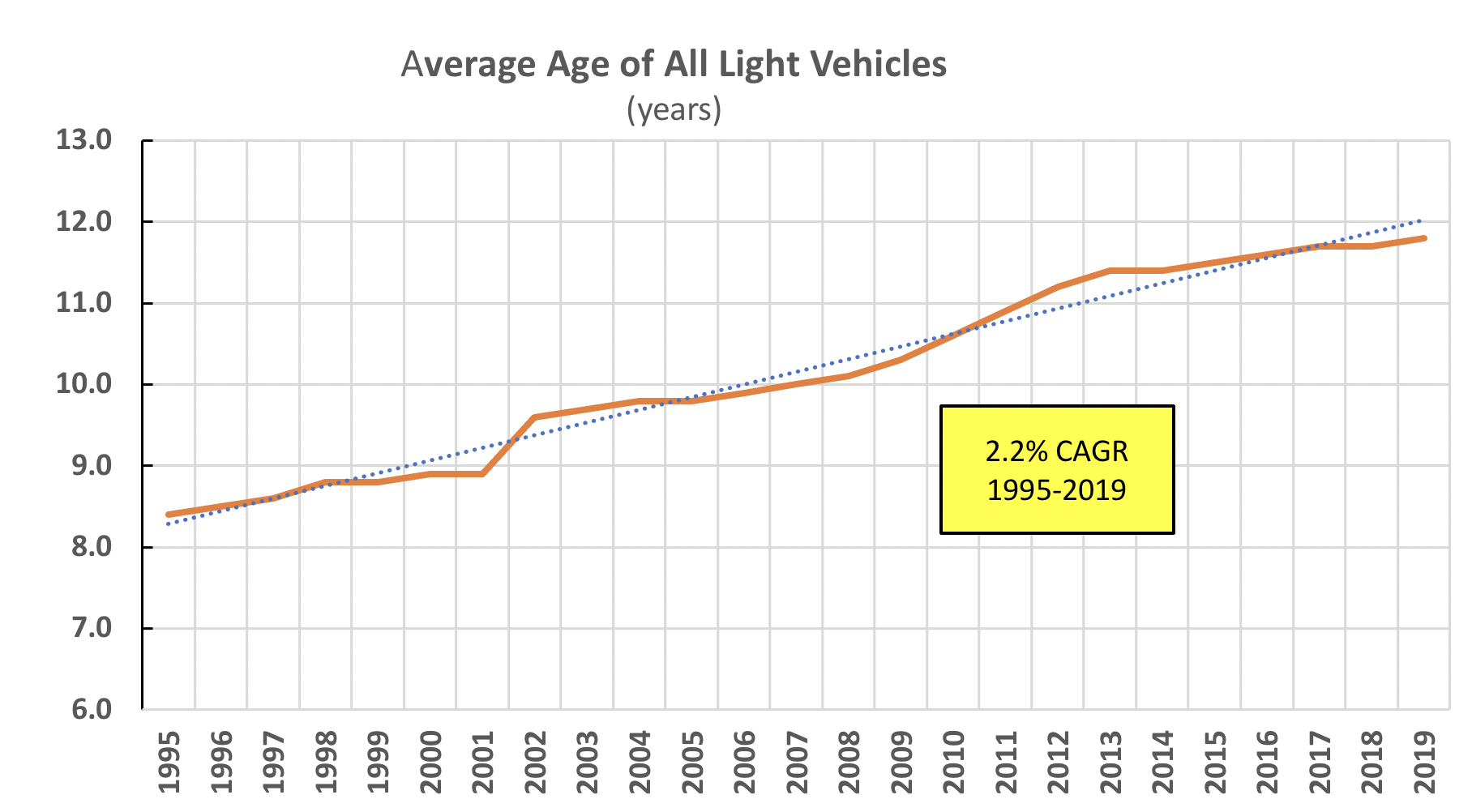

• The average age of light vehicles has been increasing. As vehicles age, they need greater service and more replacement parts.

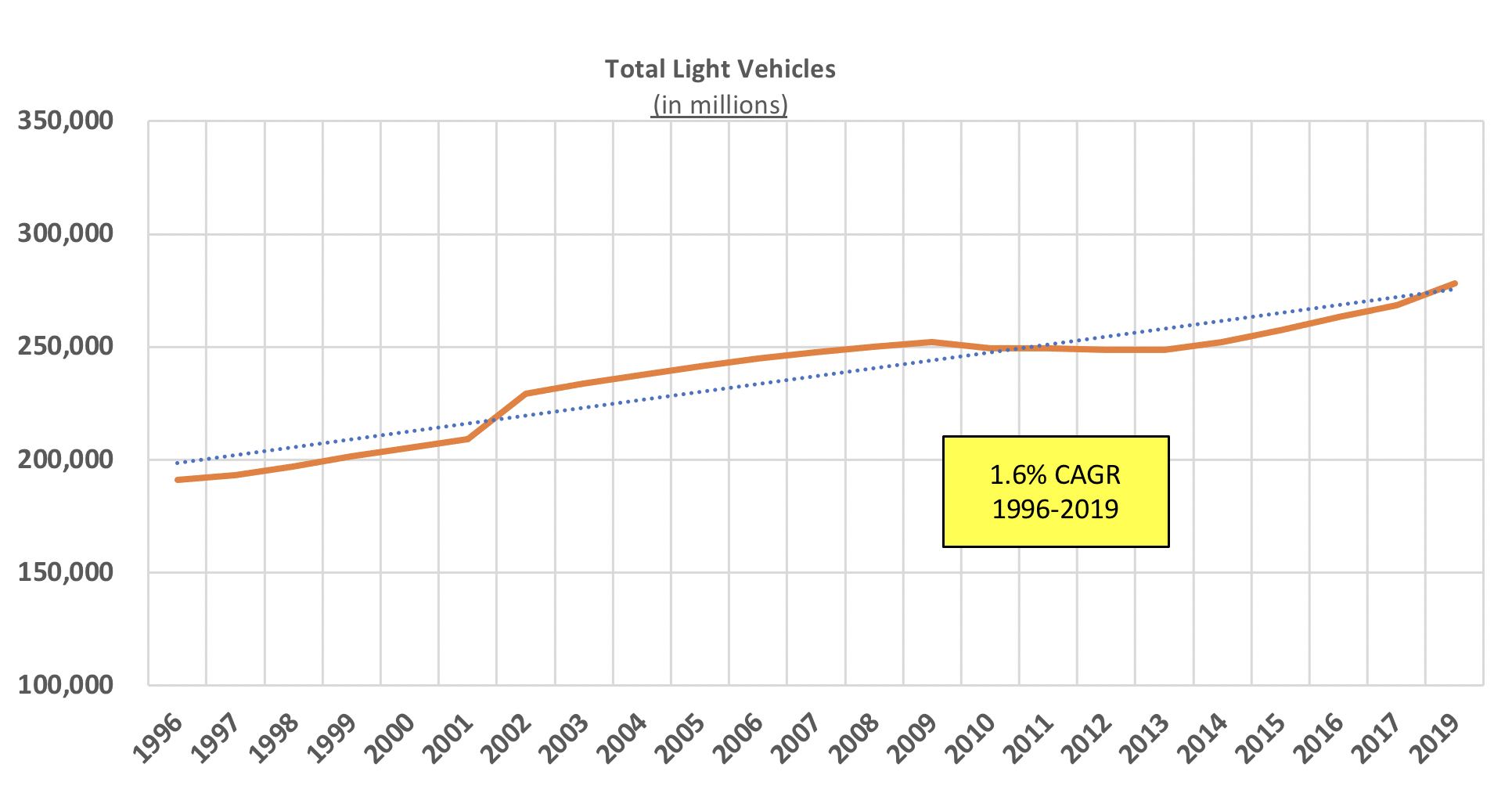

• The total number of light vehicles in use has steadily increased. More vehicles on the road results in a larger market for service and parts.

The two premier organizations representing the automotive industry…the Auto Care Association and the Automotive Aftermarket Suppliers Association (AASA)…show the light-duty automotive aftermarket is large and stable…currently about $300 billion in sales for parts and service…and is projected to continue growing in the future.

In summary, the light-duty automotive aftermarket is a very stable and highly predictable market. Short-term economic disruptions are overcome and sales return to a steady growth pattern.

(1) U.S. Department of Transportation (DOT), Federal Highway Administration (FHWA) (2019) Highway Statistics 2018 (details)

(2) Center for Sustainable Systems, University of Michigan 2019. Personal Transportation Factsheet Pub. No. CSS01-07

(3) Auto Care Association / Automotive Aftermarket Suppliers Association (AASA) Channel Forecast Model – Chart 6

Chart 1

Chart 2

Chart 3

Chart 4

Chart 5

Chart 6